Bonus issues and stock splits are 2 well-known corporate actions that publicly listed companies undertake to boost the number of shares traded. Although they appear to be same, there is a fundamental difference between the two. This article will cover these differences in a comprehensive manner covering what are they and why company comes with bonus issues and stock split.

What is a Stock Split

A Stock Split is an exercise where the company divides the existing shares into multiple shares.Think of it as cutting a 6-inch pizza into 8 slices from 4 slices.For example, if you are holding 100 shares of ABC company at Rs 100/- and stock gets split by 1:2 which means your 1 stock share became 2 now, so the total quantities of shares will be 200 but the price will become half i.e Rs 50/-(per share).

Usually, a company’s management thinks of a stock split when they want to maximize the liquidity of shares in the market. Stock splits are undertaken with the intention of increasing liquidity in the market. When share price of the company becomes expensive, smaller investors find it difficult to invest in it. To make the stock desirable, the company undertakes the split, which brings down the share price.When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets divide is the face value.

As you can see the Sunteck Realty had sub-divided their shares of face value of Rs 2 each into equity shares of face value of Re 1 on 25th, July 2017 each in order to make it affordable for small investors.

The primary benefit of a stock splits is the ability to facilitate improved liquidity of shares. Normally, companies split stocks when the share price is increasing. However, an overly aggressive split may lead to risks if the share price falls too much in the future.

What is Bonus issue

A company can reward its investors either through dividends or through bonus shares.When a company declares a bonus issue, the investors acquire bonus shares in proportion to the number of shares they hold.

For example: Suppose an ABC company announced a bonus share of 1:1 which means that a shareholder will receive 1 share for each and every 1 shares that he holds. So if you were holding 50 shares of ABC company then your net holding becomes 100 shares.You do not need to pay anything for these shares.

As you can see, PC Jeweller had recommended issue of bonus shares in the proportion of 1 equity share for every 1 existing equity share on 6th, July 2017.Bonus shares increase the number of shares in the market which changes the Earning Per Share or EPS.

Difference Between Stock Splits and Bonus Issues

A bonus is a free additional share while a stock split is the same share divided into two. Bonus Shares are only available to the existing shareholders while both existing shareholders and potential investors can benefit from the stock split.The main difference between bonus share and stock splits depends upon whether or not cash consideration is received.

Both stocks splits and bonus issues result in an increase in the number of shares outstanding.

In a stock split, fundamentals about the company is not going to change, the issued share capital remains the same, the revenue remains the same, and the profit remains the same too. The face value gets changed. If the same company goes for a stock split from the face value of 10 to the face value of 5. The number of stocks will get double and the price will get adjusted to half.

The other difference is in terms of the tax treatment of the gains in both the cases. In case of bonuses, the new shares are received at price of zero, so when calculating the capital gains this will affect the tax treatment (whether each lot is treated as a short-term or long-term gain, e.g.), while in case of splits, the stock price gets halved so the cost-basis of the gain/loss will also get halved.

| AFTER SPLIT | AFTER 1:1 BONUS | ||

|---|---|---|---|

| Stock Price | 50 | 25 | 25 |

| Face value | 10 | 5 | 10 |

| Outstanding shares | 10000 | 20000 | 20000 |

| Market Capital | 500000 | 500000 | 500000 |

| Reserve Capital | 200000 | 200000 | 100000 |

From the above table, you can see that bonus share results in a reduction of reserve capital which is used to create new shares. The stock split results in a reduction of a face value of a stock.

Handling Splits and Bonuses in Investar

Investar has unique features to handle stock events (Bonus & Split) automatically (All values will be calculated automatically, minimum or no user action required!). If you prefer, you can also maintain the splits/bonuses manually.

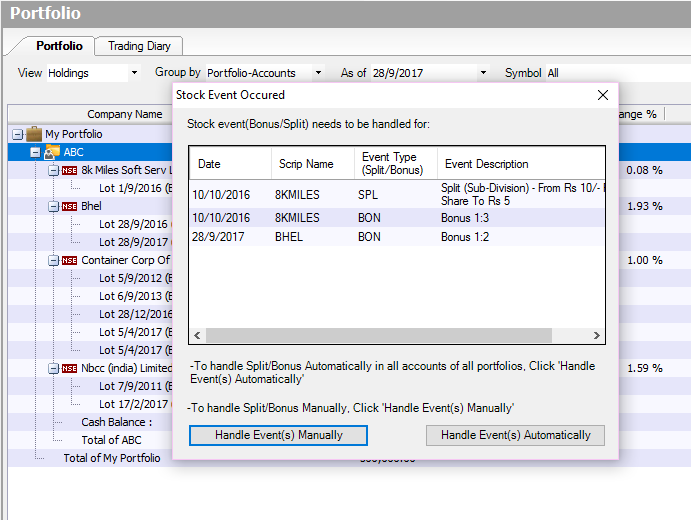

If a bonus event occurs for any stock and user has those shares which are eligible to receive bonus, then a bonus prompt is showed to user as follows

Automatic Handling

In this case, all accounts and portfolios which have transactions eligible will get automatic bonus transaction with 0 prices.

Manual Handling

In this case, user has to enter all transactions one by one for all accounts.

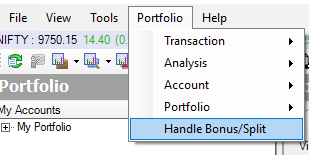

If a user cancels transaction he/she can handle them afterward using Handle Bonus/Split event menu.

Select a Portfolio from the Toolbar on top as follows:

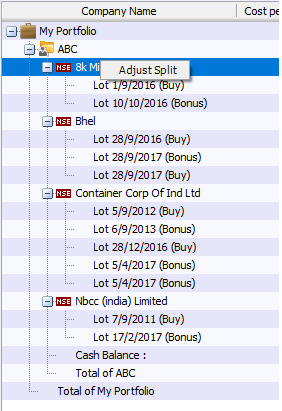

Or Right click on the stock and Adjust split.

You have to set the parameters of Qty. After Split manually.

All Bonus, Splits and Dividend details are updated on the chart automatically. No manual adjustments are required by the user to adjust the charts.

Want to try out the concepts in this blog post?

Click on the button below to download a Free 7-day trial of Investar:

Many thanks for great information

Which software u used sir

The software used is Investar software. You can take a free trial here: https://www.investarindia.com/CommonMenus/Registration.aspx

Why the price is halved in case of Bonus share as it means no benefit for the shareholder on immediate basis.

Please explain a little bit on this.

We don’t have Renko on mobile phone, but we will definitely consider your suggestion. Please clarify your question for the computer.

this is great sir.

After 1:1 bonus, stock price should be 50 only..right. but it is mentioned as 25.

A bonus is a free additional share. Price will be the same for both.

Thanks for the detailed explanation on the difference between bonus and split stock. Keep posting

Hello,

i am a bit new to trading, so i have a question.

how many shares do i will have today(21st dec 2018) if i have recieved bonus 2 times over a period.

i.e i purchased 50 shares infosys @950 on march 2015.

so how many share i will have today and what will be effective purchase price.

If you received a 1:1 bonus 2 times, your effective price will 950/4 = 237.5 and you will have 50*4 = 200 shares

With regards to taxation, the cost basis for the bonus share is zero, but for the original share it stays the same, so effectively the average cost basis halves – just like in stock split. So, there shouldn’t be a difference, right? Or am I missing something?