Due to popular demand, we are pleased to bring equity mutual fund charts to Investar (currently available in Investar Beta). Now you can track all equity mutual funds with Investar and perform technical analysis.

Just as Technical Analysis is used on stocks to time the entries and exits, similarly it can also be used on Mutual Funds to do long-term investing using weekly and higher time-frame NAV charts.

What are mutual funds?

A mutual fund is a kind of investment that uses money from many investors to invest in stocks, bonds or other types of investment. While there is no legal definition of the term “mutual fund”, it is most commonly applied to open-ended investment companies, which are collective investment vehicles that are regulated and sold to the general public on a daily basis.

Mutual funds are usually “open ended”, meaning that new investors can join in the fund at any time. When this happens, new units, which are like shares, are given to the new investors.

How does it work?

Follow this quick tutorial to view mutual fund data in Investar software, Investar helps you in:

Search any fund, Analyze historical performance.

Step 1: Open Investar and click on Lookup symbol for chart.

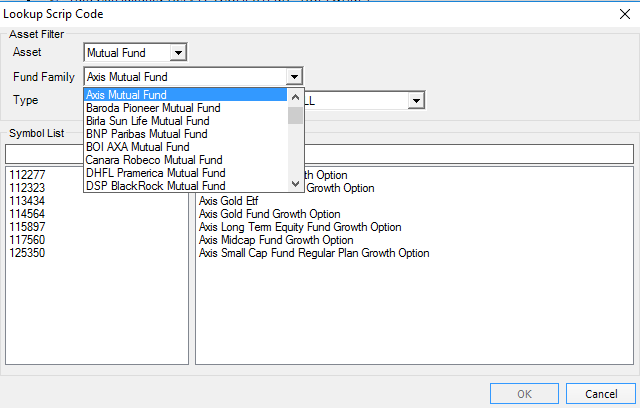

Select Mutual fund from the list and a dialog box will prompt for you showing details about the mutual fund

In the above screenshot you will see various boxes, let me explain the use of each of them:

Asset: It is a simple drop down box showing various options such as Mutual Fund, Stock, Commodity, etc.

Fund Family: A group of mutual funds offered by one Fund Company.

Type: A mutual fund scheme can be classified into open-ended scheme or close-ended scheme depending on its maturity period.

Open-ended fund/scheme: Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at the net asset value (NAV) computed that day. Most open-end funds also sell shares to the public every day; these shares are also priced at NAV. A professional investment manager oversees the portfolio, buying and selling securities as appropriate. The total investment in the fund will vary based on share purchases, share redemptions and fluctuation in market valuation. There is no legal limit on the number of shares that can be issued.

Close-ended fund/scheme: Closed-end funds generally issue shares to the public only once, when they are created through an initial public offering. Their shares are then listed for trading on a stock exchange. Investors who no longer wish to invest in the fund cannot sell their shares back to the fund (as they can with an open-end fund). Instead, they must sell their shares to another investor in the market; the price they receive may be significantly different from NAV. It may be at a “premium” to NAV (i.e., Higher than NAV) or, more commonly, at a “discount” to NAV (i.e., Lower than NAV). A professional investment manager oversees the portfolio, buying and selling securities as appropriate.

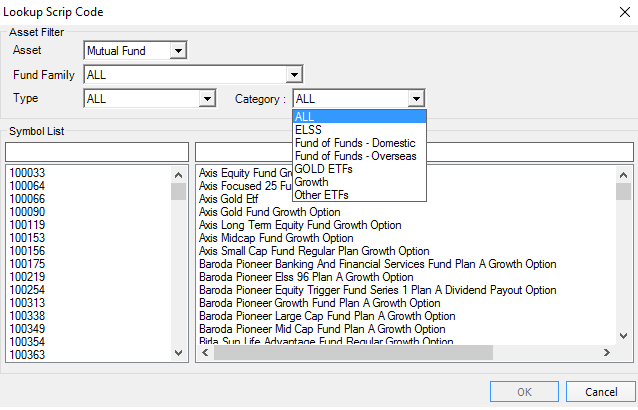

Category:

EFTs: Exchange Traded Funds (ETFs) track an index, a commodity or a basket of assets as closely as possible, but trade like shares on the stock exchanges. They invest in stocks of companies, precious metals or currencies. ETFs give you the flexibility to buy and sell units throughout the day, on the stock exchanges.

Gold ETFs: Gold ETFs cannot be strictly called mutual funds. They invest in gold and each unit in an ETF represents one gram. They securely save the gold in lockers on behalf of investors and investors are credited with units in their demat accounts. These units trade on the NSE/BSE.

Fund-of-funds: These funds invest in other funds. Similar to balanced funds, they try to make asset allocation and diversification easier for the investor.

ELSS: Equity-linked savings scheme popularly known as ELSS is open-ended, diversified equity schemes offered by mutual funds in India. ELSS can be invested using both SIP (Systematic Investment Plan) and lump sum investment options. There is 3 year lock-in period, and thus has better Liquidity compared to other options like the NSC and Public Provident Fund. ELSS is considered one of the best tax saving instrument.

Step 2: Select the desired type, assets or category. In Symbol list you can either type symbol or company name Eg: in the above screenshot we need to look up for Axis Midcap Fund Growth so we can either look for symbol by typing AMFII code as “114564” or we can search by typing “Axis…”

Step 3: Click OK after you are done.

You can also add indicators such as supertrend, RSI to get perfect buy/sell signals

Direct Plan Vs Regular Plan

A Direct plan is what you buy straight from the mutual fund company, whereas a Regular plan is what you buy from an advisor, broker.

Asset management companies (AMC) allowed direct investments in mutual fund schemes much before 2011. Direct mutual fund plans are the type where AMC / mutual fund Houses do not charge distributor expenses / trail fees / transaction charges. ‘Direct’ means no intermediaries.

That’s why the Direct mutual fund schemes have lower Expense Ratio than that of Regular plans. This is the key reason why the NAV of a direct plan will be higher than the NAV of a regular plan of the same scheme.

If you are a persistent investor with deep knowledge, meaning that you can pick and track your own mutual funds, then the direct plan is better because you can avoid the added expense incurred

You have really helped several of individuals, who have been searching internet from past quite a long time to find detailed information on this particular topic.

Thanks

One must select fund houses which have a reasonably long and consistent track record apart from a strong parentage- this would ensure processes and capability which should ideally result in performance over a period of time. Thanks for sharing a great article.

Stocks are riskier than mutual funds. Funds pool a lot of stocks (in a stock fund) or bonds (in a bond fund). That reduces risk because, if one company in the fund has a poor manager, a losing strategy, or even just bad luck, its loss is balanced by other businesses that perform well. Thanks for sharing.

Hi ..superb blog. Thank you for your information.. you can also visit Financial Education, Business, Money Management, Investment Consulting, Economics, India, Chennai, Bangalore