Support/Resistance Analysis is one of the most important aspects of Technical Analysis. It is used to determine when to buy, possible targets, stop-losses etc.

Lets first start with the basic definition of support and resistance.

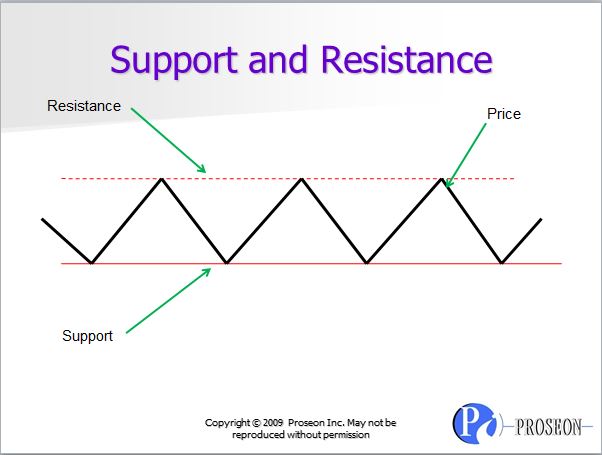

Support: An area on the chart where buying pressure overtakes selling pressure and the market reacts higher. It is identified by troughs or previous lows on a price chart.

Resistance: An area on the chart where selling pressure overtakes buying pressure and the market reacts lower. It is identified by previous highs or peaks in the price chart.

A simple way to depict the support and resistance is as shown in the figure below (this type of price action is also called a sideways trend in Technical Analysis where the stock is fluctuating between the support and resistance).

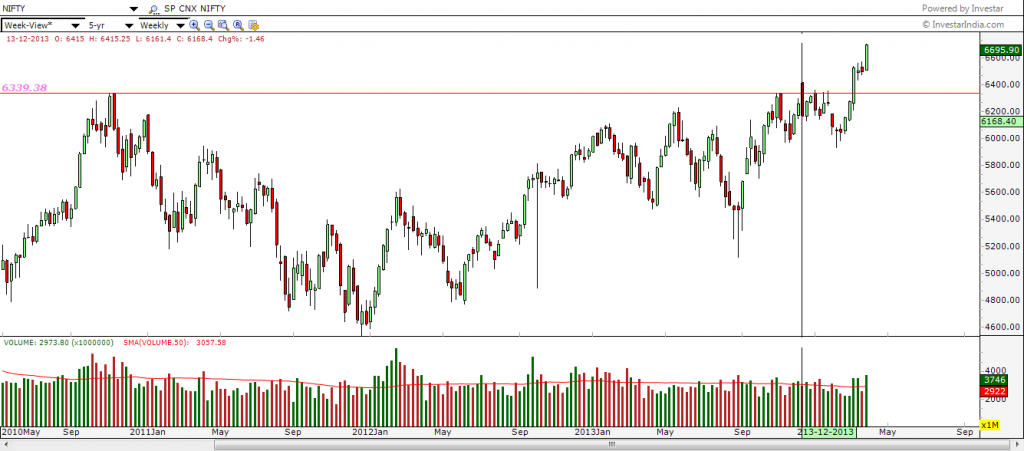

Based on the definition, when you want to draw a support line, you draw it through the lows of the price chart. But things get a little complicated because not always will all the lows align well. In that case, it is considered perfectly okay to draw the support line through the lows and if a low penetrates the support line, it’s considered okay as long as the close is not below the support line.

Similarly, when you want to draw a resistance line, you draw it through the highs of the price chart. But if a high penetrates the resistance line, it’s considered okay as long as the close is not above the resistance line.

This is best illustrated in the recent Nifty chart where on the weekly chart, we did not have a break above the 6340 on the week ending 13th December, even though the Nifty made a high of 6415:

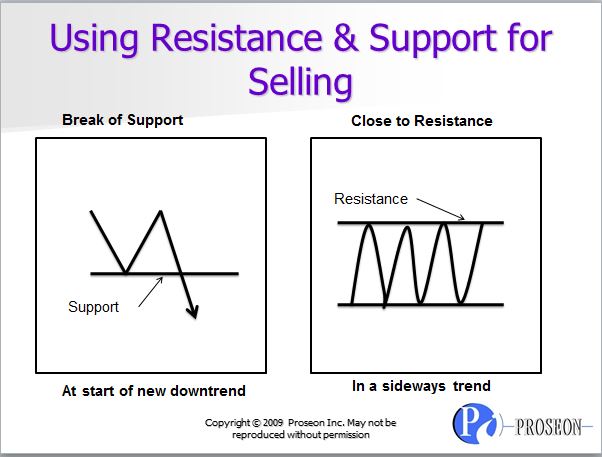

But how are support/resistance levels used in trading? That really depends on what kind of trend is existing. If it is a sideways trend, you buy at support and sell at resistance (as shown in figure below). If however, you want to buy a stock (which is usually at the start of a new uptrend), then you would do that when the resistance is broken to the upside. And if you want to sell a stock, you would do that when the support is broken to the downside. The techniques for using the support/resistance in trading are summarized in the figures below:

Once all the support/resistance lines are drawn the next step is to judge the strength of different support/resistance levels, how do decide which one to trade on? What if two support levels or resistance levels are broken at the same time? Which ones do you use in your trading then?

For that, we need to understand the factors that contribute to the strength of a support/resistance level so that we can decide how much importance we can give to it:

- How many peaks or troughs does it touch? – The more the touches, the stronger it is. Intuitively, this is because if a support/resistance line is tested a multiple times, the chances of success on a breakout also go up.

- Is there a volume accompanying the support/resistance break? –The stronger the volume, the stronger is the breakout and the lesser the chances of failure.

Both the points above constitute what is called the volume breakout strategy, where you enter a security when the resistance is broken on volume. But we will cover that in a separate post in the future.

Very good article. I definitely love this website. Continue the good work!