You must have read the term “Multibagger” number of times in the past. Before we begin let us give you a quick definition of what exactly is Multibagger.

A long-term multibagger stock is an equity stock which gives a return of more than 100%. Means, multibaggers are stocks whose prices have risen multiple times their initial investment values. For example, a ten bagger is a stock which gives returns equal to 10 times the investment, while a twenty bagger stock gives a return of 20 times.

For a short-term multibagger we are looking for a gain of 30-40% within a few days.

While a long-term multibagger requires Fundamental Analysis as well as Technical Analysis, while a short-term multibagger can be identified using only Technical Analysis.

Short-term Multibagger using a modified Multi timeframe Volume Breakout Strategy

In this blog we will learn how to identify even more short term Multibaggers using a modified Multi timeframe Volume Breakout Strategy and find out how to identify the sector to look for in terms of short-term multibaggers.

This blog elaborates further on the Multi-timeframe Volume Breakout strategy presented few weeks back and shows how to make it even more successful by:

- identifying market conditions under which it is more successful.

- by using Auto-Support/Resistance and Auto-Supply/Demand Zones in Daily timeframe in addition to Downtrend line breakout to identify even more such stocks.

So, to begin with, in this strategy we will take a comparison of NIFTY and NIFTY Smallcap 50

We can clearly see that in weekly timeframe NIFTY did started a new trend which was downtrend. In same way, we can also see in NIFTY Smallcap 50 there was an indication of long term downtrend. So during this time it is not advisable to go after any long term bullish strategy.

For short-term strategy (the time period for which is 2-4 weeks duration), let’s select the Daily timeframe

We can see that while NIFTY is in sideways trend, NIFTY Smallcap 50 has broken out of sideways trend a few days back and hence is showing a possible uptrend. We are not sure if this is a long term uptrend or not but it is definitely a short term bullish uptrend and due to this we can easily say that the short term multibaggers stocks will be more easily be found in small-cap stocks.

How to identify such short term Multibaggers easily?

We will use Multi-timeframe Volume Breakout Trading strategy with various variations.

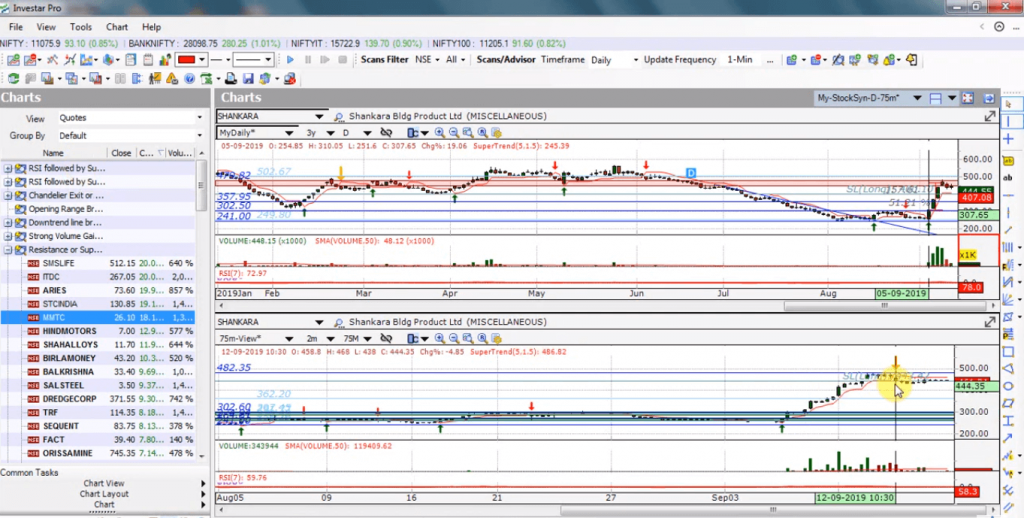

Let’s take another stock i.e Shankara Building Products Ltd to understand this strategy, and then simply enable Auto SRT, which will enable the Auto-Support/Resistance and Auto-Supply/Demand Zones.

It is very clearly from the above chart that on 5th September, 2019. This stock had made a breakout with high volume on Daily timeframe and we can also see same stock in 75-min timeframe where it has also broke the supply/resistance zone with high volume on the 15:30 candle.

The correct entry point for this stock would be at the closing of the 3:30 pm candle near the market close. So, if you had traded on this stock you would have gained almost 40% profit.

To exit the stock, we can use the pre-defined Custom Scans RSI followed by Supertrend – Sell to exit on 12th September,2019 at10:30 a.m (as indicated by the orange signal applied on the 75-min timeframe chart).

So to summarize this, we make an entry using 75-min timeframe on the last candle i.e 03:30pm where this stock had made a breakout with high volume and on daily timeframe where it also had a very strong resistance breakout and exit the stock using RSI followed by Supertrend scan.

Which scans to use for identifying such Multibaggers?

Investar gives you a wide range of in-built customs scans. You can use one such scan known as “Resistance or Supply Zone Breakout on above average volume”.

Simply ensure that you have a 2-chart layout in “Stock Sync” mode with Daily timeframe on top and 75-min timeframe on bottom and if you find a stock in this scan that is simultaneously breaking out of a sideways trend on high volume in both the timeframes, then that could be a potential short-term multi-bagger.

To summarize, the modified multi-timeframe volume breakout strategy involves the following:

- Support/Resistance or Supply Zone or Trendline breakout in Daily timeframe.

- Support/Resistance or Supply Zone breakout in 75-min timeframe

- High volume on breakout .

- Sideways trend before the breakout.

- Ideally, the sectoral index should have started an uptrend.

For more details, check out our video on “Multibagger Stock Strategy | Multi-timeframe Volume Breakout Strategy for identifying Multibaggers” for an in-depth look into this topic :

Nice information

Thank you

nice article

Glad you enjoyed it.

Thanks For this Informative information.

Glad you enjoyed it.