The dividend yield is a price ratio of a share distributed to shareholders relative to its share price. Dividend yield is used to calculate the earnings on investment (shares) considering only the returns in the form of total dividends declared by the company during the year.

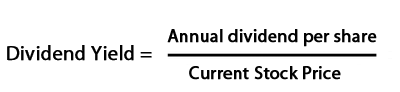

The formula for calculating dividend yield may be represented as follows:

For example, if a company’s annual dividend is Rs. 2 and the stock trades at Rs. 40, the Dividend Yield is 5%. (Rs. 2 / Rs. 40 = 0.05)

It’s important to know that a stock’s dividend yield can modify with time, whether due to market variations or simply by dividend fluctuations by the publishing company.

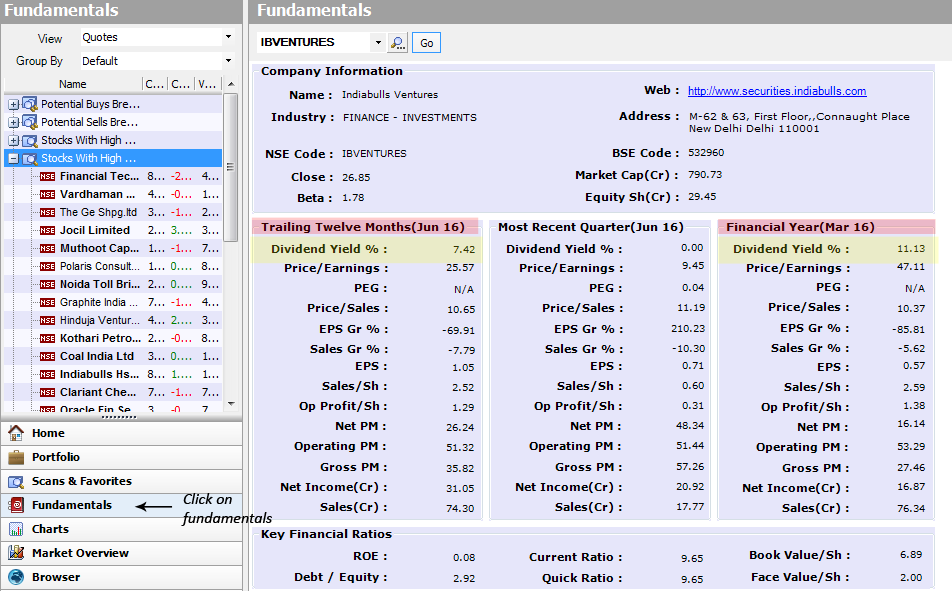

Dividend Yields are often estimated using the previous year’s yield or by taking the latest quarterly dividend multiplied by 4 divided by the current price. In Investar, we have provided 3 values of dividend yields:

FY: This is the Dividend Yield of the last Financial Year

TTM: This is the Dividend Yield considering the total Dividend per share for the last 4 Quarters.

MRQ: This is the Dividend Yield calculated using only the last quarter’s data. Although, this is not so useful, it is still provided.

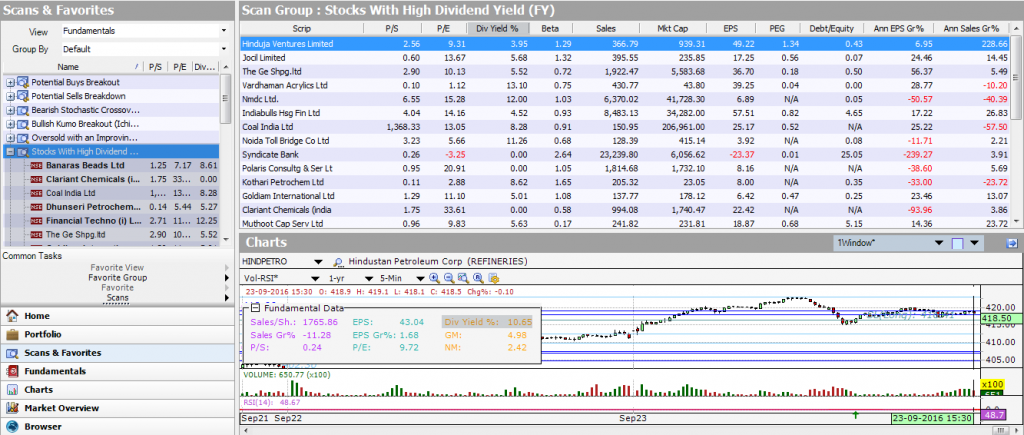

You can see the stocks with high Dividend Yield by selecting fundamentals from lower left section from Investar software.

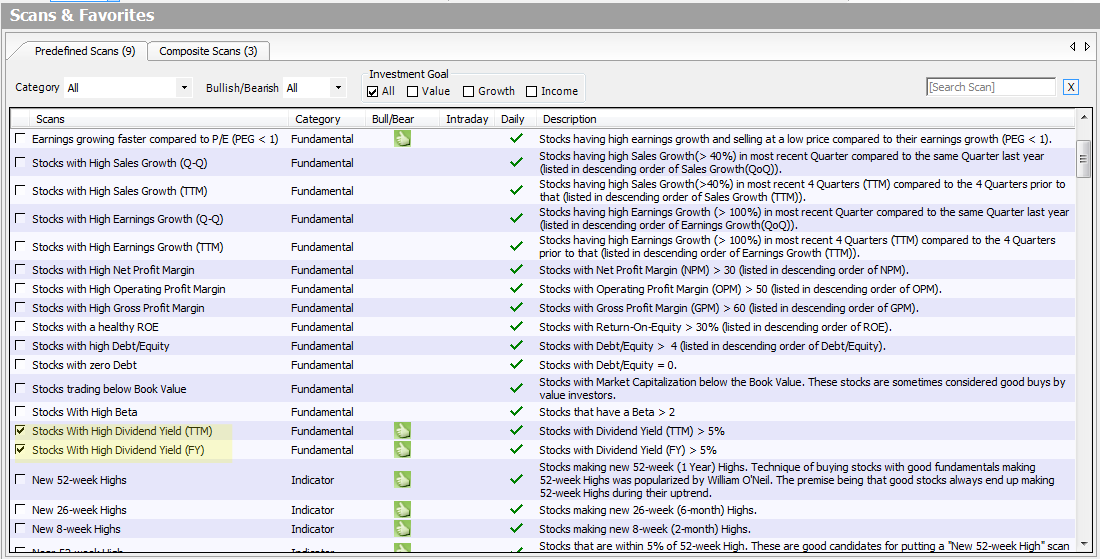

In Investar, we have added user-friendly scans to help you find high dividend yield stocks. All you have to do is to select the following scans from Predefined scans list: “Stock with high Dividend Yield (TTM)” and “Stock with high Dividend Yield (FY)”.

How to Find the Best Dividend Stocks

Investar has introduced two new scans as we have mentioned earlier in this blog post. “Stock with high Dividend Yield (TTM)” and “Stock with high Dividend Yield (FY)”. All you have to do is to select the scans from Predefined scans list and then you can easily keep track of which stock is with high dividends.

(1) select any stock from Stock with high Dividend Yield (TTM/FY) scans and (2) select View Scans /Favorites with charts to keep track of which stock is with high dividends.

Stock with high Dividend Yield (TTM):Trailing dividend yield gives the dividend percentage paid over a prior period, typically one year. A trailing twelve month dividend yield, denoted as “TTM”, includes all dividends paid during the past 4 quarters in order to calculate the dividend yield. It can be considered as more current compared to the FY dividend yield.

A high dividend yield may sometimes be considered to be evidence that a stock is underpriced or that the company has fallen on hard times and future dividends will not be as high as previous ones. Similarly a low dividend yield can be sometimes be considered evidence that the stock is overpriced or that future dividends might be higher.

A higher dividend yield is however desirable for many investors especially if the share price has fallen a lot. This is because not only can the investor get a capital appreciation if the stock goes up, but also interest in terms of the dividend yield. Some investors use this fact to invest in high dividend yield stocks rather than putting their money in a bank.