In this post, we will look at a low-risk Nifty Option Trading Strategy using Auto-Support/Resistance and Auto-Supply/Demand Zones.

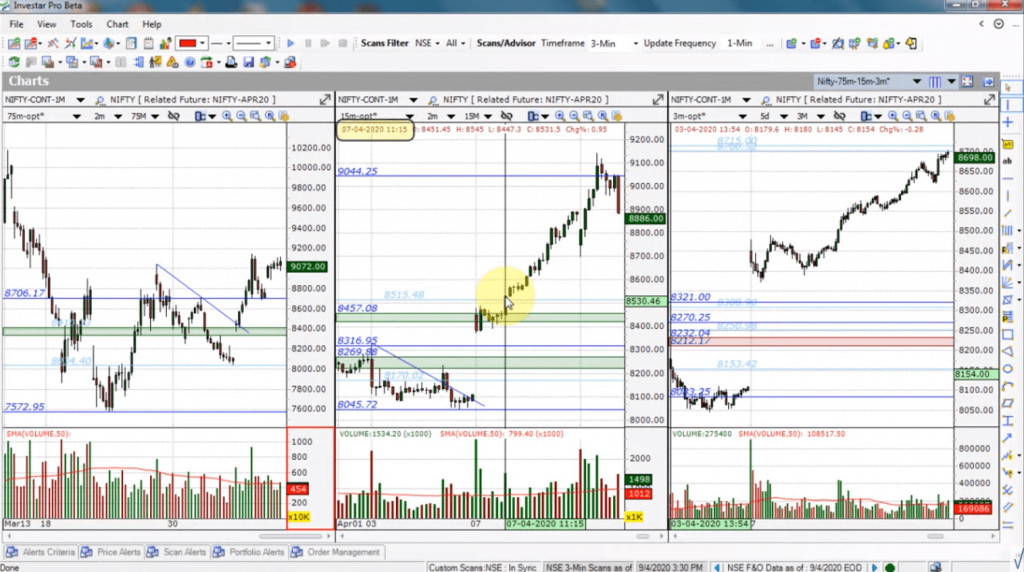

As can be seen in the chart below, the Nifty has been volatile since end of Feb, 2020 and we want to look at a strategy where we can specially take advantage of volatility.

As can be seen in the chart below, the Nifty did a gap up opening on 7th Apr, 20 and after that it gave a nice uptrend till 9th Apr, 20. So, how could we have caught this uptrend and profited from it?

To find out that, let’s enable Auto-Support/Resistance and Auto-Supply/Demand Zones and when you do that, we can see that Investar plots the Support/Resistance and Supply/Demand Zones automatically using Artificial Intelligence. For better accuracy, we will do our analysis of Nifty Future (NIFTY-CONT-1M) chart in multiple timeframes. If we see the charts in the 3 time frames as below, we can see that NIFTY-CONT-1M broke out of 15-min timeframe on 7th Apr, 20 at 11:15 am. To fine tune our precise entry, we can look at the 3-min chart and we find that the exact entry point would have been 11:06 am when it broke out of 8490, and this was a volume breakout in the Nifty future as can be seen by the above average volume at this time. Hence we would need to trade our CALL or PUT option at this time.

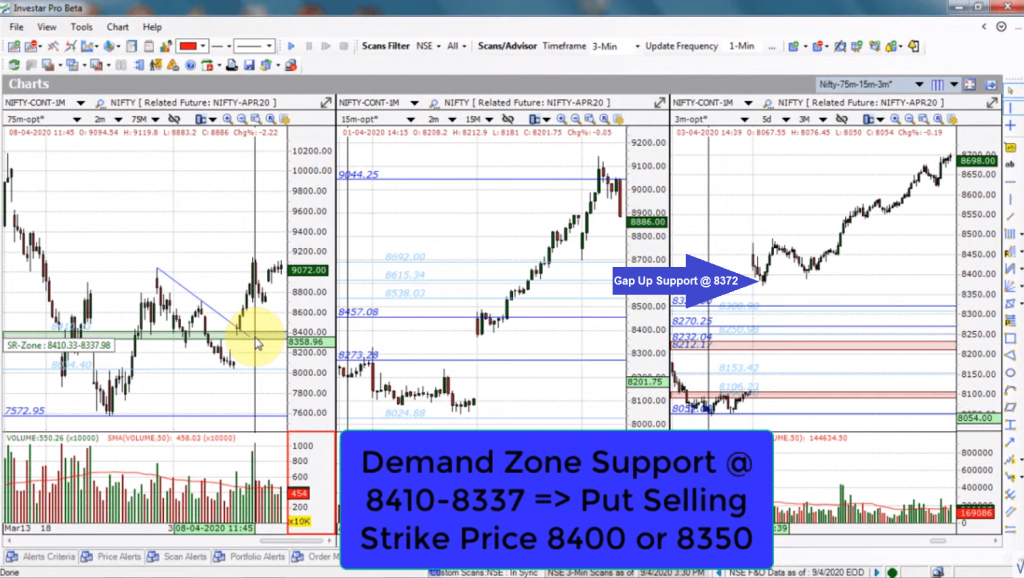

To fine tune our precise entry, we can look at the 3-min chart (see screenshot below) and we find that the exact entry point would have been 11:06 am when it broke out of 8490, and this was a volume breakout in the Nifty future as can be seen by the above average volume at this time. Hence we would need to trade our CALL or PUT option at this time.

In order to find out the Strike Price of the Option, we see that there was Gap-up Support at 8372 and also a Demand Zone support at 8410-8337 in the 75-min timeframe. Hence we can choose Strike Prices of 8350 and 8400 for selling the Puts (since we are bullish).

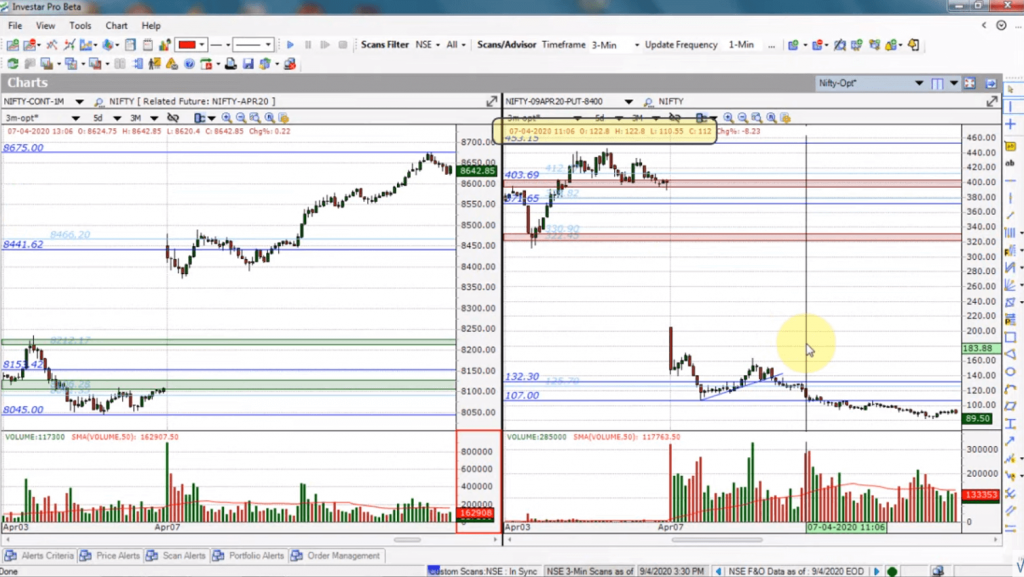

If we now go to a NIFTY-09APR20-PUT-8400 chart, we can get the exact entry price as 112 at 11:06 am, and we would be selling our Nifty Puts here.

When selling Puts, it is extremely important to put a proper stop-loss and the Stop-Loss can be the nearest Auto-Resistance (dark blue line) of 132 or 50% above our buying price of 112.

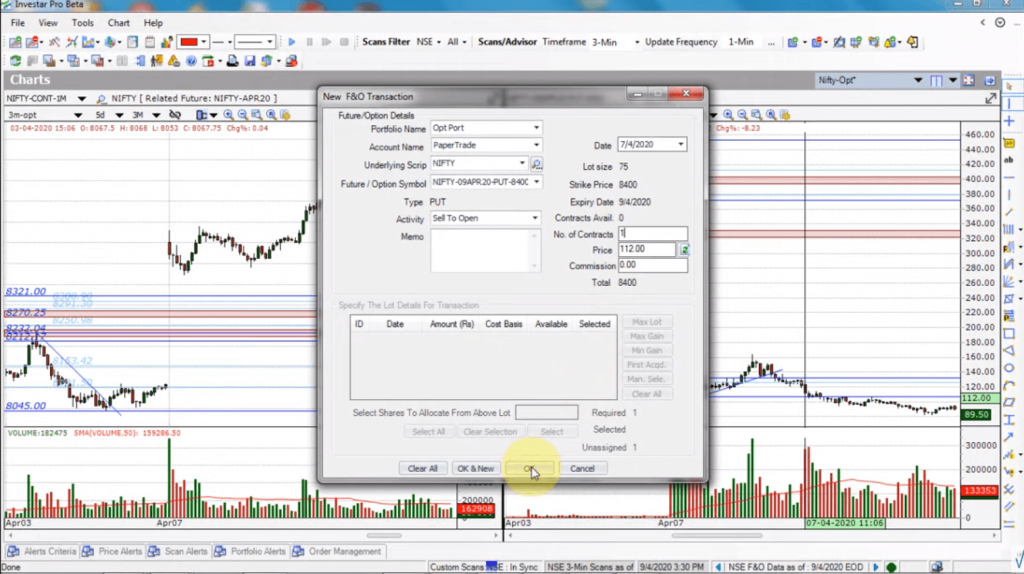

We can paper trade this by simply right-clicking on the Chart and selecting “Enter Portfolio Transaction” and the details of the transaction are automatically entered as shown below.

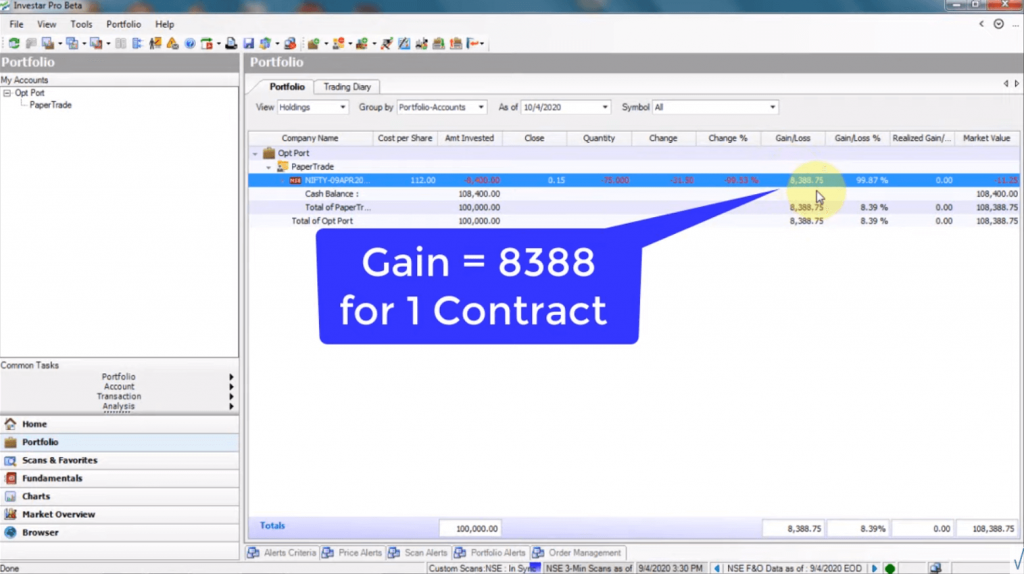

As can be seen, the gain was almost Rs 8388 because the Put we sold expired worthless by the expiry day. Moreover, we also maximized the premium by timing the trade perfectly.

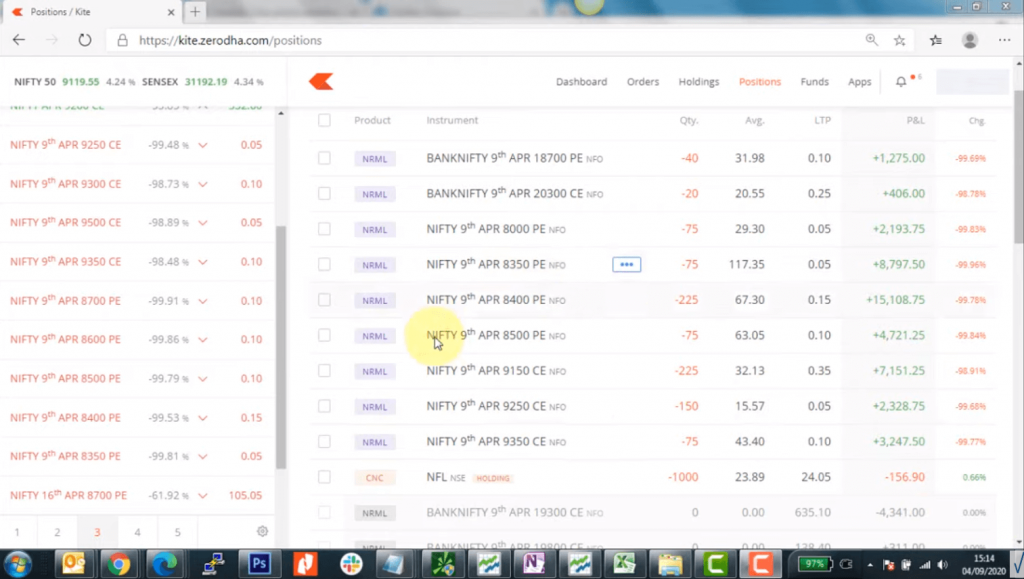

Another thing that can be done is that as the Nifty nears a resistance, we can also sell Calls before expiry and get even more profits. The actual trades as a result of this Low-Risk Nifty Option Trading strategy are shown in the screenshot below and you can see that it was quite profitable.

We hope you learnt some concepts on how to trade Nifty in volatile markets using this Nifty Option Trading Strategy. For more details about this Nifty Trading Strategy, please see this video:

Want to try out this Nifty Option Trading Strategy?

Click on the button below to download a Free 7-day trial of Investar:

I couldn’t find better article than yours for this topic which I was trying

to learn about. It is indeed a great article to read! Had awesome time

reading it… Thanks and keep up the good work!

Glad you enjoyed it.

thanks for NIFTY trading strategies.

Glad you enjoyed it.